For contractors, self-employed, part-timers, gig-workers, small business owners, and those without benefits

Need Affordable Healthcare, Retirement Solutions,

& Ways to Save?

Just ASK POINDEXTER!

Skip the high premiums and sky-high deductibles. Discover budget friendly health, vision, dental, life and mortgage insurance, and a ton of perks. All tailored for how people actually live their best lives.

Always Open for Enrollment

Health and Wellness Benefits:

Healthcare: Access to affordable medical, dental, and vision

Wellness: Access and credits towards your out-of-pocket requirements for taking car of your health

Telehealth Services: Convenient online healthcare consultations.

And much more...

Affordable Healthcare Solutions — One Easy Choice

Whether you're an independent contractor, business owner, or someone who just needs an affordable plan you can use, we’ve got healthcare options designed to fit your needs and budget.

Sign up any time of the year.

Health Sharing A cost-effective health-sharing alternative offering flexible coverage and significant savings. Join a community committed to sharing medical costs without the complexities of traditional insurance.

Save, Build & Give

Make a Difference Every Month Just By Paying Your Bills

How Much Do You

$pend Each Month?

You can pay off your car, your mortgage, your phone, even a credit card, but you can never pay off your cell phone bill, internet, electricity, gas bill, etc.

Save money each month on the essential service bills you're already paying for.

Build your savings and/or retirement, send your kids to college, go on vacation, get out of debt, etc. with what you're saving each month.

Every time you pay a bill with our company, a child gets a meal through our Project Feeding Kids.

Complete the survey by clicking the button below and

someone from our team will get back to you shortly.

Unlock access to the best life has to offer

with exclusive savings on:

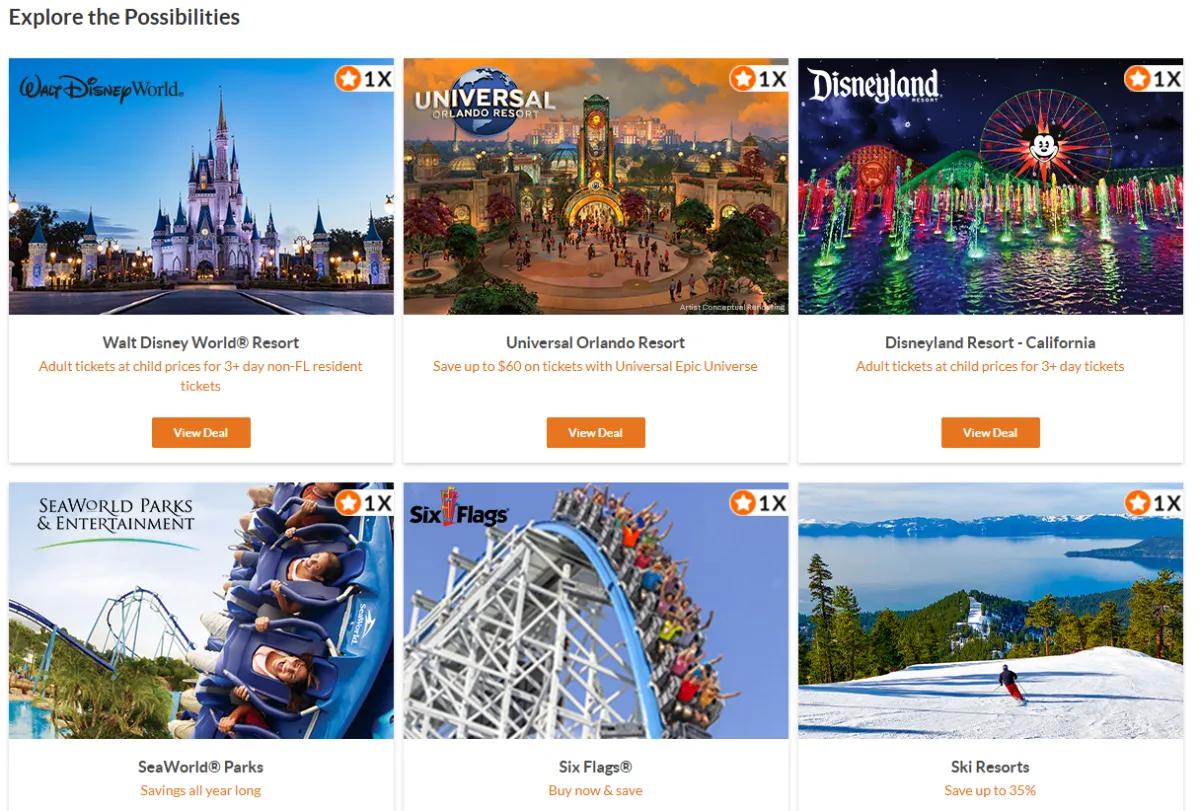

Theme Parks, Attractions and Shows,

Hotels, Flights and Rental Cars,

Concerts, Sports and Live Events,

Movie Tickets, Electronics & Much More.

You don't have to miss out on all the 'perks' because you aren't working a corporate job.

Get unlimited access to these perks...

When you fill out the survey.

Be Ready for the Just in Case...

Sometimes life throws curveballs. Knowing you have Urgent Care and Hospitalization covered, provides peace of mind, ensuring you and your loved ones have access to quality care when unexpected emergencies arise, allowing you to focus on healing and recovery, without the added stress of a mountain of medical bills.

Affordable healthcare helps protect your financial well-being during challenging times so you can focus on what really matters - being there for the person you love most, and sometimes that person is YOU.

One of our options offers "Wellness Credits" of up to $150/month for being proactive in your self-care.

Want to know more?

Simply request a quote.

A Mission Driven by Personal Experience

Meet Belinda, the Founder of Ask Poindexter

Years ago, my oldest son, Alex, and I created a business to help small business owners provide benefits to their people. We partnered with other small businesses, knowing that Main Street America is the backbone of our economy. But managing the platform proved too time-consuming for many, so we had to shut it down.

Today, the need is greater than ever—but our approach is simpler. Employers simply share our information, and our team takes care of the rest, so they can focus on running their businesses.

This mission is deeply personal. After Alex passed away over three years ago, it became more than just a business—it became a calling. I’ve seen firsthand how overwhelming healthcare can be, especially in crisis. During Alex’s final months, I battled a broken system, drowning in medical bills and endless calls. No one should have to fight for care while grieving.

That’s why I’ve partnered with incredible people and organizations to bring financial relief and peace of mind to those who need it most. Together, we’re making benefits work for you.

Be sure to mention who referred you when you contact us or request a quote, so the right partner can assist you.

Frequently Asked Questions

Answers To Commonly Questions

What is health sharing?

Watch this quick explainer video on YouTube from the founder

How does Impact Health Sharing actually work?

This explainer video will cover how Impact Health Sharing works, what happens when you go to the doctor, what a Primary Responsiblity Amount (PRA) and Co-Share are, and your max out of pocket.

Does Impact cover pre-existing conditions?

Pre-Existing Medical Conditions are conditions in which known signs, symptoms, testing, diagnosis, treatment, or use of medication occurred within 36 months prior to membership (based on medical records). A known sign is any abnormality indicative of disease, discovered on examination/diagnostic testing before joining membership. A symptom is any subjective evidence of disease. In contrast, a sign is objective.

A Pre-Existing Medical Condition is eligible for sharing after the condition has gone 36 consecutive months without known signs, symptoms, testing, diagnosis, treatment, or medication (based on medical records).

If you have been diagnosed with cancer that is in complete remission and you are only undergoing testing for surveillance purposes, then bills related to those services will not be eligible for sharing for the first 36 months of membership. If after 36 months you are without signs, symptoms, testing (other than surveillance testing), diagnosis, or treatment (medication), medical expenses related to that cancer diagnosis will be eligible for sharing.

High blood pressure or high cholesterol that is controlled through medication will not be considered as Pre-Existing Medical Condition for purposes of determining eligibility for future vascular or cardiac signs.

The Pre-Existing Medical Conditions limitations do not apply to members 65 years old and older.

If I find a job that has healthcare, do I have to cancel my current healthcare plan and use theirs?

No. You may keep your current health plan. However, you do want to compare it to what your employer is offering. If you don't think this will be a long-term position, then consider keeping what you have. As for your life insurance policy, always, always, always keep that. It's never a good idea to rely on your employer to provide this. You can supplement it with your employer provided one if you wish to, but it's not the best investment vehicle or cost effective like the one you have already setup based on your financial planning strategy.

Can I enroll at any time?

Yes. You can enroll at any time.

WIth Impact HealthSharing: as long as you have enrolled and paid for your membership by 5:59pm EST of the last day of the month, your membership will go into affect on the first of the following month.

With LifeExec: as long as you have enrolled and paid for your membership by the 20th of the month, your membership will go into affect by the first of the following month.

What about major medical? I have more questions...

With Impact Healthsharing: it covers major events as long as it is not a pre-existing condition.

With LifeExec: Advantage Complete is currently the only plan that has access to a fund. However, they are about to bring on some plans that can be stand-alone or added onto others that will offer access to much more.

Can anyone use these services?

Yes. We are an inclusive organization that is here to help those who are looking for access to healthcare benefits that are affordable and affordable to use -- that's a really big deal!

These plans aren't dependent on where you work, if you work, or how much you make. If you start a new business, leave a job, you lose your benefits, it doesn't matter. Not here.

Why is this important? Because in life things change. Health changes, and when you experience health changes it can impact the cost of health insurance, being eligible, your health care costs, etc. When you have your own policies, you're not starting over all the time, getting new doctors, dealing with new premiums and deductibles, etc.

My team is here for you so that you are in control of your own care. Your own planning needs.

What is Long Term Care?

Long Term Care is

Having a terminal, serious, or chronic illness diagnosis

Becoming disabled

Needing long-term care

The policy will specify which illnesses or injuries qualify for the benefits. There may also be a waiting period before the benefits can be used.

What does No Network or National Network mean?

With Impact: There is no network. You may use any provider, hospital, specialist, etc. You do not require any prior authorizations in order to get the care you need. However, your doctor must send the order to any lab, imaging, etc. to let them know what is needed. No more fighting with insurance companies to get needed care on eligible care.

With LifeExec: The National Network is actually First Health, who have tens of thousands of providers, urgent care and hospital facilities across the US in all areas and specialties. Including virtual telehealth and mental health services. You can use whichever provider you choose.

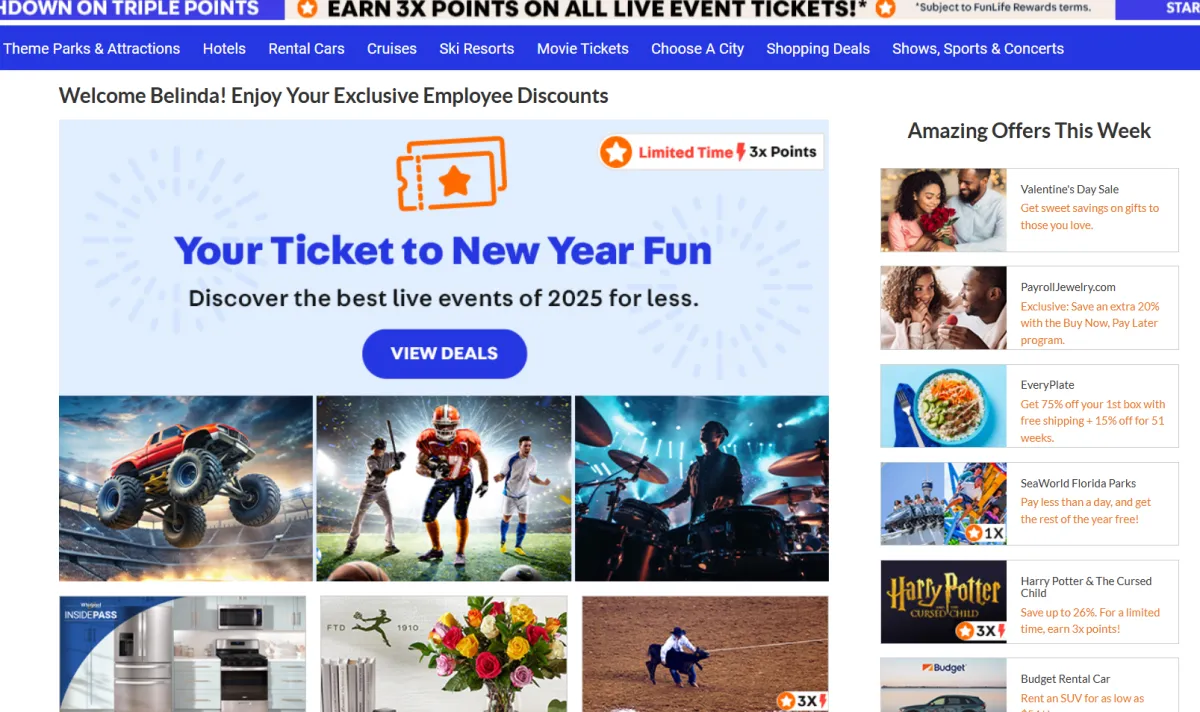

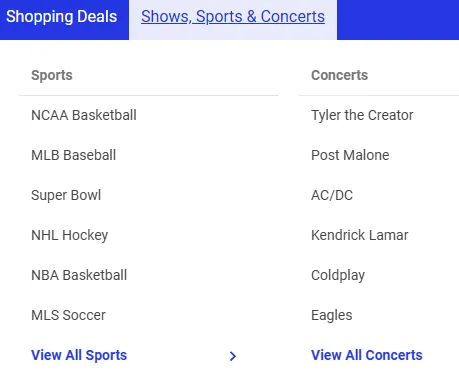

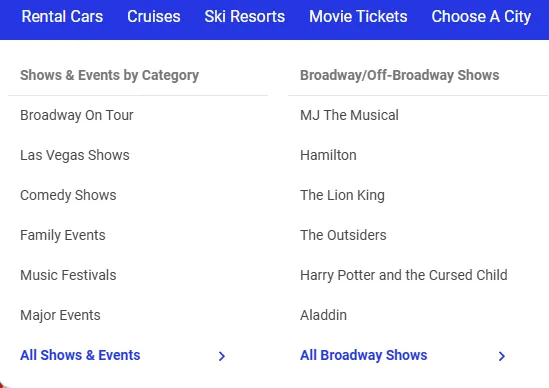

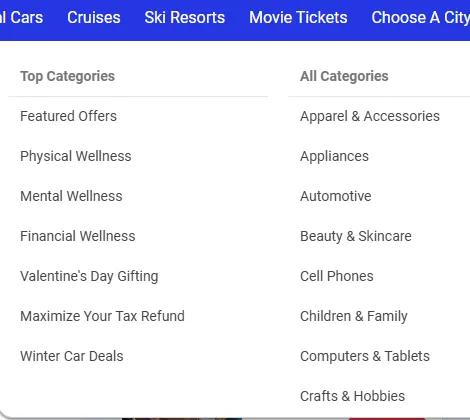

What kinds of perks are there?

You will have exclusive access to offers from a variety of discounts and savings on:

Theme parks: Exclusive discounts on tickets to theme parks like Disneyland, Walt Disney World, Universal Studios, and Legoland

Shows: Discounts on tickets to Broadway shows, concerts, and other shows

Concerts & Sporting events: Discounts on tickets to concerts and sporting events

Movie tickets: Discounts on movie tickets

Hotels: Discounts on hotels

Car rentals: Savings on car rentals

Tours and attractions: Savings on tours and attractions

You will have access to a corporate entertainment benefits provider that offers exclusive discounts and special offers to employees of companies that participate in the program. The program is free for our clients to enroll in.

These perks offer exclusive partnerships with some of the most prominent entertainment brands, including: Universal Orlando, Cirque du Soleil, SeaWorld Parks and Entertainment, and much more...

I have more questions...

Please email us at [email protected] and someone from our team will reach out to you, get you a quick quote and/or answer your questions.

Copyrights 2024 | Ask Poindexter™ | Terms & Conditions